If something seems too good to be true, it probably is. Add cryptocurrency yield farms to that list. A complex investment strategy in decentralized finance markets, yield farming advertises eye-popping passively earned returns. While some investors boast impressive returns, for others the risks are unclear or even undisclosed before they invest, and the advertised returns never materialize.

Article written by: Ty Burke

Illustration by: Sébastien Thibault

New research by Desautels Faculty of Management Professor Patrick Augustin shows that when investors chase farms advertised as having high headline rates and yields, they often don’t know how to take advantage of blockchain benefits—and don’t get what they bargained for.

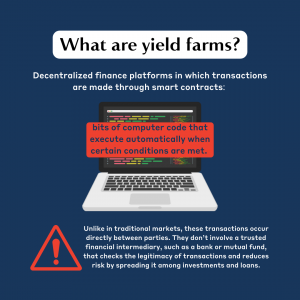

Yield farms are decentralized finance platforms in which transactions are made through smart contracts: bits of computer code that execute automatically when certain conditions are met. Unlike in traditional markets, these transactions occur directly between parties. They don’t involve a trusted financial intermediary, such as a bank or mutual fund, that checks the legitimacy of transactions and reduces risk by spreading it among investments and loans.

“The risks in yield farming are not very transparent,” says Augustin. “On average, the farms in our sample advertised yields of about 78 per cent, but investors don’t always know the risks or how to maximize returns.”

Liquidity and volatility in decentralized markets

In research paper “Reaching for Yield in Decentralized Financial Markets,” Augustin analyzed trades from a yield farm platform called PancakeSwap. Its colourful interface includes smiling cartoon animals and promises of millions to be won in prizes. PancakeSwap looks like a game, but billions of dollars worth of cryptocurrency have been traded through it. On the platform, investors can make their cryptocurrencies available in liquidity pools where other investors buy and sell.

“Investors provide liquidity; they don’t actually buy and sell but provide cryptocurrency that others trade,” explains Augustin. “The traders pay a fee for each transaction and investors collect that. It is a flat fee, so the return becomes larger with higher trading volume. That is their incentive.”

Investors provide liquidity; they don’t actually buy and sell.

Augustin adds that this process is similar to securities lending in traditional financial markets. There, security owners can lend shares to someone who wants to short or own a stock. “They lend it as a service, without actually selling it, and are compensated for that,” he says.

But there is a price risk centred around cryptocurrency’s volatility. Invested cryptocurrency is held in a yield farm’s pools, which always consist of two different cryptocurrencies. Investors supply an equal dollar amount each. However, while their investment is in the pool, investors remain subject to the cryptocurrency price variation, which is influenced by the pool’s liquidity.

So, when investors withdraw their cryptocurrencies, they may redeem at values lower than their initial investments despite receiving compensation from trading fees.

Staking claims on the blockchain

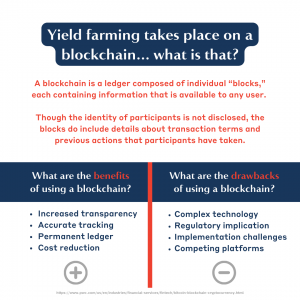

Despite such downsides, yield farming remains popular. Yield farming takes place on a blockchain, which provides rich information about individual transactions. A blockchain is a ledger composed of individual “blocks,” each containing information that is available to any user. Though the identity of participants is not disclosed, the blocks do include details about transaction terms and previous actions that participants have taken.

Augustin’s analysis found that investors’ decisions are not sensitive to the magnitude of downside risks. When new risks are disclosed, investors tend to stay with their chosen yield farm even after the risk-reward ratio has changed.

Investors are also making clear mistakes, says Augustin. One of these is leaving money on the table by failing to take an action or “staking their investment,” which they will benefit from. He explains that once an investor becomes a liquidity provider, they receive a certificate called a liquidity token that is a like a certificate of partial ownership of the pool.

“You can leave it on the blockchain, but that doesn’t do anything for you,” says Augustin. “Or you can stake it, which allows it to be lent a second time and earn additional income. That’s the actual yield farming part. But about a fifth of investors don’t do this.”

Your cryptocurrency is already invested, so there is no benefit to not staking.

He explains that investors must make a choice to “stake the token” and are always better off if they do: “Your cryptocurrency is already invested, so there is no benefit to not staking. It’s a mistake. And on the blockchain, we can see who is staking and who is not.”

Transaction data reveals performance and risk

The blockchain also allows analysis of investors actual returns. When yield farms’ performance is broken down, it comes in much lower than advertised.

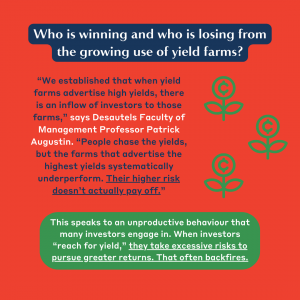

“We established that when yield farms advertise high yields, there is an inflow of investors to those farms,” says Augustin. “People chase the yields, but the farms that advertise the highest yields systematically underperform. Their higher risk doesn’t actually pay off.”

This speaks to an unproductive behaviour that many investors engage in. When investors “reach for yield,” they take excessive risks to pursue greater returns. That often backfires, and not just for retail or crypto investors.

We established that when yield farms advertise high yields, there is an inflow of investors to those farms.

“We also see this from institutional investors, such as pension or mutual fund managers,” says Augustin. “They have a mandate and are sometimes encouraged to take on higher risks to show they can outperform the market or beat a benchmark. But by doing that, they may systematically underperform.”

For retail investors, reaching for yield is like a behavioural bias, explains Augustin. Since individual investors are attracted to product features that are marketed aggressively, like price, they tend to overweight the value of these features and potentially disregard other features, like risks: “They disregard risks and are disappointed when they do materialize.”

Regulatory frameworks could help investors understand risk

Yield farmers could clearly benefit from a better understanding of the risks. But decentralized finance platforms like PancakeSwap currently have no fiduciary duty to their customers. They aren’t required to disclose any specific risks, or act in their best interests. But this responsibility does exist in traditional finance, as with financial advisors.

“There are many similarities between yield farms and traditional financial products, but there is no clear regulatory framework for them. If individual investors are allowed to participate, we need to assess how the products should be structured,” says Augustin.

“If a low-income person has $100 in savings to invest, they should be aware of the risks associated with investing in a yield farm,” he adds. “We have gone through similar experiences with other products that involve financial innovation. Think about the complexity associated with subprime mortgage-backed securities. Because of that, we can learn about this context more quickly.”

But some unique challenges might stand in the way of regulating decentralized finance.

“It’s very different from regulating traditional financial services. Because it’s decentralized, you don’t know who the developer actually is,” Augustin explains. “And there is little taxonomy of what we’re talking about. Is a cryptocurrency token a form of currency, or a commodity? That has implications and isn’t necessarily clear.”