Bank loans are the typical first step for most small and medium-sized businesses to get off the ground, expand, or diversify, whether a restaurant, retail store, publishing company, or construction business. However, for entrepreneurs and new businesses without collateral and credit, securing bank funding is difficult. In recent years, another form of business lending has emerged: FinTech companies that use algorithms to determine whether a business is worth the risk.

Subscribe:

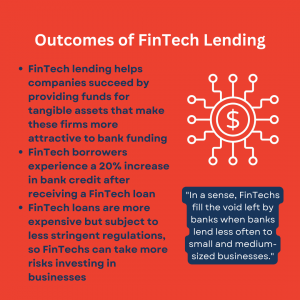

In his research on the role of FinTech funding for small and medium-sized businesses, Desautels Professor Paul Beaumont found that firms served by FinTech platforms have fewer tangible assets than bank borrowers—yet relative to similar firms that take out bank loans or were denied FinTech credit, FinTech borrowers experience a long-term 20% increase in bank credit after receiving their FinTech loan.

On the Delve podcast, Beaumont discusses why this change in bank lending appeal happens and what businesses are most likely to experience it, as well as what the longer-term outlook of FinTech financing on small and medium-sized businesses might look like. Will there be an increase in successful businesses or certain types of businesses thanks to this alternative form of financing? And will banks start to change their tune about what businesses they fund in the first place?

Increasing credit and collateral

When small firms try to obtain financing from banks, the classical problem they face is “information asymmetry,” says Beaumont, meaning that it’s difficult for a bank to know whether a new enterprise with no or limited credit history will default, not be profitable from the outset, or shut down when exposed to shocks such as a recession or far-reaching events like the COVID pandemic.

Information asymmetry has caused major friction in bank lending since the 1980s, with more unreliable firms applying for loans and defaulting on them. These high default rates caused banks to increase interest rates, which caused reliable, non-defaulting or “good” firms to not even apply for loans. Society loses as well, as qualifying firms who don’t apply for financing aren’t able to bring their products and services to market. One way that banks have tried to overcome information asymmetry is with more information, such as credit history and accepted credible signals that indicate that an entrepreneur or a firm won’t default. Collateral, including machines, equipment, real estate, and other property, is vital today.

FinTech lending is complimentary to bank lending.

“We found that firms invest more in tangible assets after getting a FinTech loan, and therefore the increase in bank credit is stronger when firms invest in these assets,” Beaumont explains. “It’s consistent with this idea that FinTech lending is, in a sense, complementary to bank lending.”

Bank barriers and FinTech accessibility

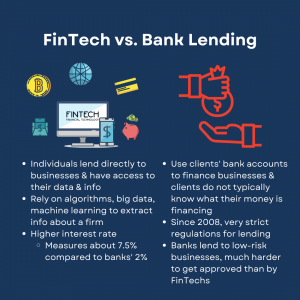

Unlike banks, which manage the money of millions of clients and are regulated heavily due to that responsibility and risk, FinTech platforms—also called Peer-to-Peer (P2P) lending businesses—are more akin to individuals who lend directly to small firms. While still beholden to regulations and a certain amount of risk, FinTech loan assessments use data and algorithms to make lending decisions.

“It’s normal that FinTechs are regulated, but the main goal of regulation is to prevent fraud,” says Beaumont, pointing out that FinTechs face lower regulatory costs than banks. “As long as people are allowed to invest in the stock market, there is no clear reason why they should not be allowed also to lend directly to small and medium-sized firms.”

Another factor that sets FinTech companies apart is their higher interest rate, which currently measures about 7.5 percent to banks’ corporate loan interest rates of around 2 percent. Hand in hand with that, however, is the fact that different types of small businesses go to FinTechs than go to banks, since the likelihood of being approved by a FinTech is higher. In that sense, FinTechs are providing a different product to a different set of businesses.

“It’s not the same firms that borrow from FinTechs,” Beaumont explains. “Typically, the firms that borrow from FinTechs are smaller and have less tangible assets. This suggests that banks and FinTechs are not competing exactly on the same market. If they were competing on the same market, they should more or less deal with the same firms and prices should be comparable—otherwise, they would be priced out.”

Innovation yields innovative businesses

Today’s FinTech market is still small compared to banks yet represents an innovative leap in the small business lending market.

FinTechs fill the void left by banks when banks lend less often to small and medium-sized businesses.

“We have been lending the same way to small and medium-sized enterprises now for decades,” says Beaumont. “FinTechs constitute an innovation in the way we lend to firms. This is exciting because it means that finally we have invented a new business model to provide funds to small and medium-sized businesses… What we observed is that, in a sense, FinTechs fill the void left by banks when banks lend less often to small and medium-sized businesses.”

Ultimately, why does funding to small and medium-sized businesses matter so much? In terms of job creation, SMEs represent a large proportion of job creation rates in most economies. As well, new small enterprises are often responding to growth opportunities, such as new developments in an industry or to brand new markets.

“It’s very important from a societal perspective to make sure that we allocate the right amount of financing to these firms,” says Beaumont. “Every type of innovation in the market is important from a societal perspective… If FinTechs widen the range of products available to small and medium-sized enterprises, it means that SMEs in a sense will be able to do more things to finance more diverse projects.”

FinTech lending companies themselves are innovative in their market, in fact. “One major thing that FinTechs did is to show to the world that you can have a different business model and still be profitable,” Beaumont explains. “And you can actually lend money in new ways to small firms. It’s important to know that it’s possible to innovate in that market.

As the FinTech industry grows in popularity among a larger variety of businesses and evolves alongside changing economies and technologies, what can we expect in the coming years from both FinTech and the many businesses these companies finance? We’ll have to pay attention to both the economy and the research.

For more insights, listen to the podcast with Professor Paul Beaumont.

This episode of the Delve podcast is produced by Delve and Robyn Fadden. Original music by Saku Mantere.

Delve is the official thought leadership platform of McGill University’s Desautels Faculty of Management. Subscribe to the Delve podcast on all major podcast platforms, including Apple podcasts and Spotify, and follow Delve on LinkedIn, Facebook, Twitter, Instagram, and YouTube.